Banco de Oro (BDO) is one of the largest banks in the Philippines. It offers banking products and services to retail and corporate markets and clients. BDO is known for its wide range of products for millions of customers.

I am a loyal customer of BDO as it has proven its quality banking products and service. The bank continues to innovate and improve its service for a better banking experience for all of its customers. One proof of BDO’s innovation is its digital banking.

BDO offers online banking through its website and its mobile app. Learn more about the BDO Digital Banking app and its features below. Discover how I used the BDO Digital Banking app to apply for a BDO credit card.

- Getting to Know Banco De Oro

- Introducing the BDO Digital Banking App

- Starting with the BDO Digital Banking App

- Managing My Accounts on the BDO Digital Banking App

- Paying Bills and Buying Load Using the App

- Applying for a Credit Card Through BDO Digital Banking

Getting to Know Banco De Oro

BDO Unibank, Inc., more commonly known as Banco De Oro or BDO, is part of the SM Group. BDO is headquartered in Mandaluyong City, Philippines. It has been rendering banking services to Filipinos since January 1962.

BDO has been the largest bank in the Philippines since March 2016 and placed 15th in Southeast Asia. The bank dominates the country in market capitalization because of its full-service banking products and services.

It offers a wide range of products and services like lending for corporate, SMEs, and consumers, deposit-taking, brokering, foreign exchange, trust and investments, credit cards, corporate management, and remittances.

BDO proves that it finds ways for its customers for all of their banking and financial needs. In addition, BDO has the following services: leasing and financing, private banking, investment banking, insurance brokerage, stock brokerage, and bancassurance.

Knowing BDO’s Dedication to Its Customers

I trusted BDO because of its wide range of products and services. It also provides quality customer support for all our needs. These prove that BDO’s intention to help people with their banking and financial needs is pure.

The bank ensures it is accessible to its customers by having over 1,300 operating branches and more than 4,000 ATMs in the Philippines. BDO found a way to be there whenever customers need its services.

Moreover, BDO promised to continuously improve its products for the benefit of its customers. As proof, BDO innovated to make banking services available for us anytime and anywhere through its BDO Digital Banking mobile app.

Introducing the BDO Digital Banking App

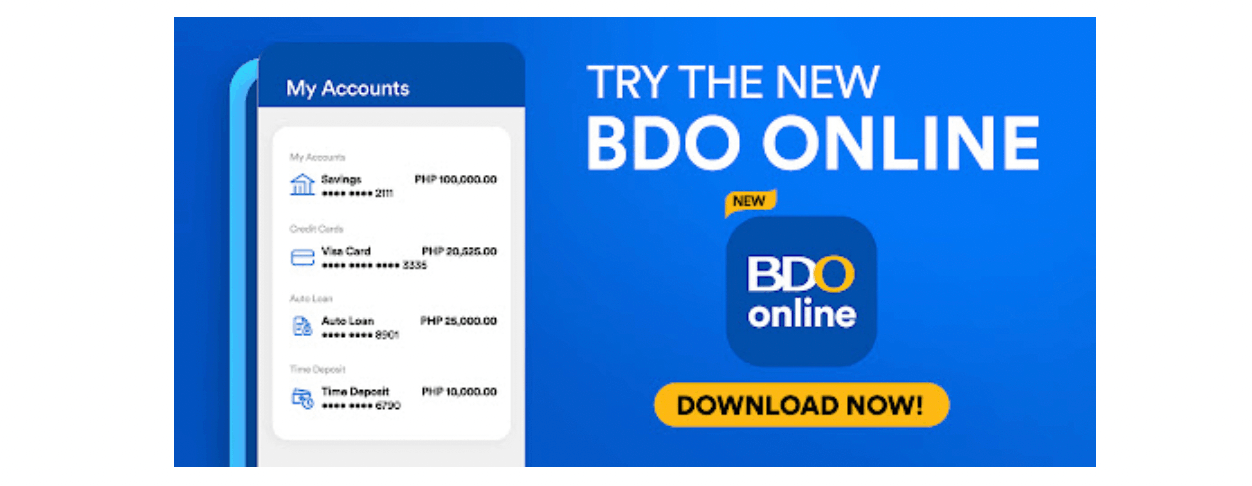

When banks started to offer online banking, BDO did not waste time and immediately followed suit. It wanted its customers to have access to its products 24/7 at their fingertips with its BDO Digital Banking app.

I had been a customer already before BDO launched its banking app in July 2013. Interestingly, the app helps me manage all my BDO accounts in one place. I can check all the transactions and my account balances in one place.

BDO continuously improves the mobile banking app to give the best banking experience to us, its customers. Now, it has improved security features and supports online bills payment. BDO Digital Banking provides other services like prepaid load and many more.

The BDO Digital Banking mobile app is available on the Google Play Store and the Apple App Store and it is free to install. BDO Digital Banking runs on devices with AndroidOS 4.4 and up and iOS 9.0 or later.

Reading BDO Digital Banking’s Privacy Policy

Before installing the app, I admit there was hesitancy. It is because of the potential threat to my data privacy, especially since there is sensitive personal information in banking. I made sure that I could trust the BDO Digital Banking app before downloading it.

I read its Privacy Policy to know how it will ensure that my personal information will be safeguarded. First, the app listed all the information it will only collect, like name, contact details, address, IDs, income, and other transactions on the BDO Digital Banking app.

Then, BDO Digital Banking emphasized that it will only use, store, and share the collected data for legal purposes, transactions, policies and obligations, and research. It promised that no one could access my personal information except for the said purposes.

Starting with the BDO Digital Banking App

BDO first launched its digital banking services thru its official website and eventually on its mobile banking app. Installing the BDO Digital Banking app reminded me to keep my account secure by verifying devices linked to my BDO Digital Banking account.

There is also an overview of the security features of the app. BDO understands that its customers are concerned that other people might be able to open or access my account on my phone. Thus, it offers a security feature wherein I can enable face and fingerprint verification.

BDO Digital Banking app supports logging in and verifying all transactions using my face and fingerprint. This helps avoid issues when my phone gets stolen or lost, and other people might do something with my BDO account.

In addition, BDO Digital Banking lets me set up a personal six-digit PIN for added security. Aside from face and fingerprint verification, the PIN can confirm my transactions using the app. The six-digit PIN can also be used as a requirement to log in to my BDO Digital Banking account.

Enrolling an Account on the BDO Digital Banking App

It is usual that BDO customers already have a BDO Digital Banking user ID and password thru the official website. Thus, they can immediately log in to the BDO Digital Banking mobile app using their registered user ID and password.

New users need to enroll an account on BDO Digital Banking. Before creating an account, the app asks the new users to read and agree to its Terms and Conditions. Then, they will need to indicate their BDO account type and where they are (whether within or outside the Philippines).

The next step is to provide all the bank account details like the account numbers. They can now proceed to register their unique user ID and password. Lastly, the app asks for the mobile number and email address for verification.

Managing My Accounts on the BDO Digital Banking App

One of the primary features of the BDO Digital Banking app is account management. I am able to access all my account information in one place, such as transactions and balances.

It is helpful that I do not have to go to an ATM to check my current balance. With just a few taps on my phone, I can know how much is there on my account.

I find it accessing my account transactions and history greatly beneficial. This is because I can check if the transactions made with my account are successful, especially with deposits.

I do not need to go through receipts to check when the transactions are made. The BDO Digital Banking app provides all the details with the corresponding time and date.

Using the Quick Balance Feature

On the BDO Digital Banking app’s Home page, there is the Quick Balance feature. This option lets me view the balance without logging in on the app. This means that by launching the app, I can immediately check my account balance.

I only need to enable the feature on the Settings menu of the BDO Digital Banking app. It is possible to set up fingerprint or face verification to enable the Quick Balance feature.

Paying Bills and Buying Load Using the App

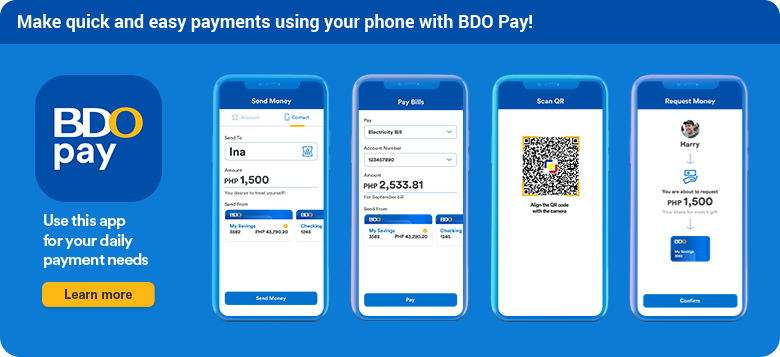

The BDO Digital Banking app ensured that it brings convenience to its users. Another feature that offers convenience is bill payment. BDO Digital Banking supports paying bills using my phone.

There are over 600 merchants that I can transact with for a purchase using the BDO Digital Banking app. There is no need to register the biller in ATMs or branches.

In addition, the BDO Digital Banking app lets me reload my prepaid mobile SIM. It is open for all the mobile networks available in the Philippines like Globe, TM, Smart, Talk and Text, and many more. With this feature, I do not need manually buy data from a store.

Sending Money Through the App

One of my most used BDO Digital Banking features is money transfer. The BDO Digital Banking app supports sending money to other banks with InstaPay. Although there is a corresponding charge, it is highly convenient.

I only need to provide the bank details of the recipient. In just a moment, the money will be transferred successfully.

Applying for a Credit Card Through BDO Digital Banking

I discovered the BDO Digital Banking app supports credit card applications through an announcement on its website. It is great timing because I am intending to visit a branch to inquire regarding a credit card application.

Fortunately, I did not need to visit a branch to apply. Since I already have a record on BDO, it is easier to apply for a credit card online. They will only be retrieving some of my personal information.

Thus, I need to provide some other details like income. After completing the application form, I needed to submit additional required documents. Then, I am done.

BDO promised that all credit card applicants will receive a call within three banking days to confirm the application.

Withdrawing Cash Using a QR Code

There are times that I forget my card, so I cannot withdraw. BDO has a solution to this problem by providing the QR Code feature on the BDO Digital Banking app.

Once I generate a QR code, I can use it to withdraw to any QR-enabled ATMs. I only need to scan the code with my phone.

Conclusion

This mobile banking app provides convenience to its users by allowing them to pay bills, buy load, manage accounts, send money, and many more.

The BDO Digital Banking app allows users to apply for a BDO credit card online. In addition, you can also use the app to track your credit card.