Budgeting or managing your finances can be cumbersome with multiple cards and accounts. Most people nowadays struggle with this daily. Multiple financial locations can make following a budget difficult, leading to some pretty bad situations.

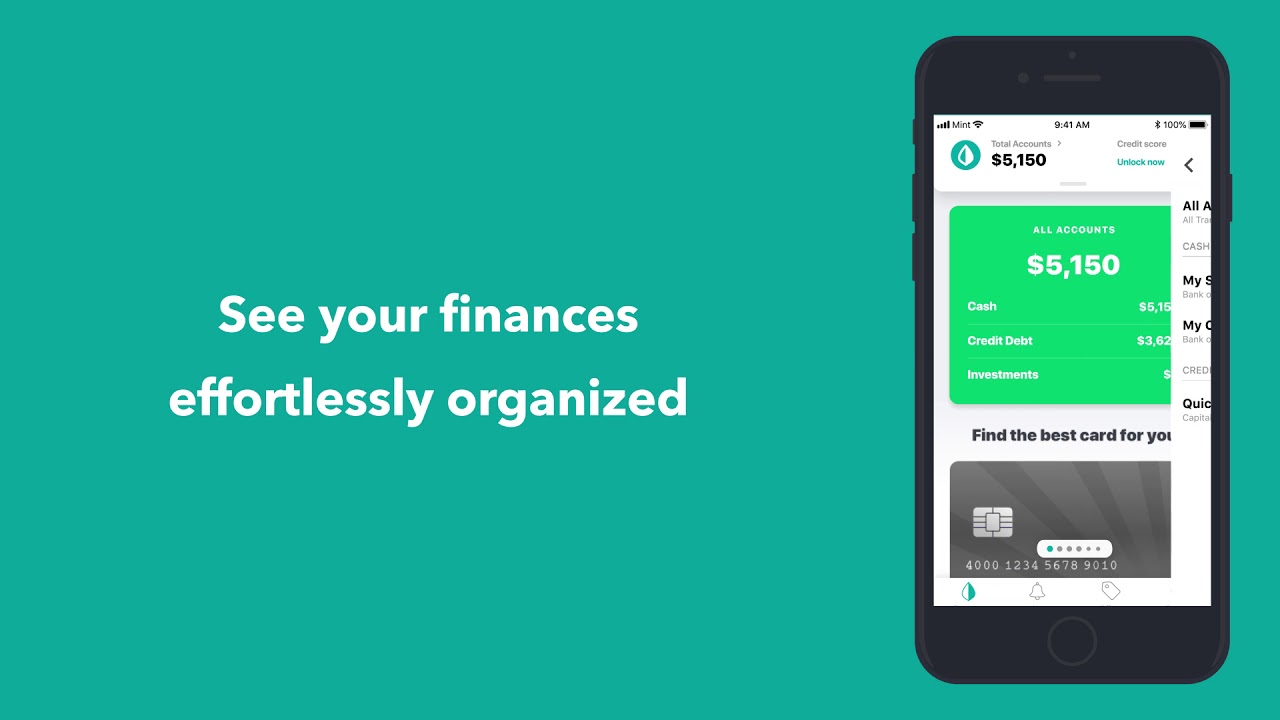

But there are apps and platforms out there that can help with this. One of these is a financial tracking app called Mint. It allows you to have a one-stop-shop to monitor your finances and keep on track with your savings.

Like anything, though, we are sure you would like to know a little more about this app. So below, we look at how you can manage finances easily and quickly with the Mint app.

The Mint App – What Is It?

The Mint app is the mobile version of the financial management tool available on Mint.com. Millions of people have used this app and site to ensure they are staying on track to meet their budget.

The tool has been around for more than a decade and is owned by Intuit. This company has been a name in the financial world since the early 80s and has built a reputation for being on the cutting edge of financial product trends.

For instance, Intuit also owns QuickBooks and TurboTax. It is an app that is recommended by financial experts like Clark Howard. The app allows its users to categorize and set financial goals for themselves.

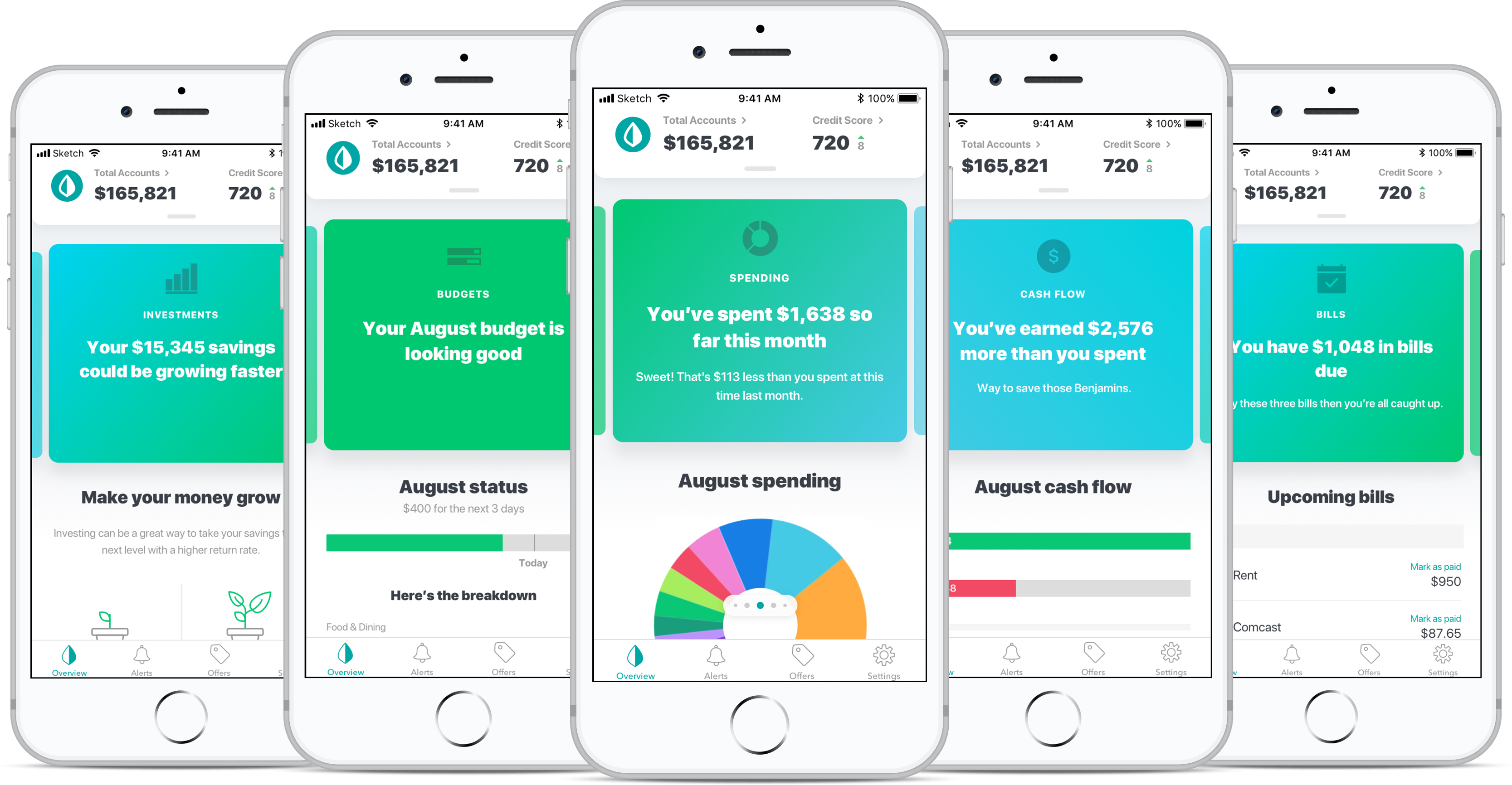

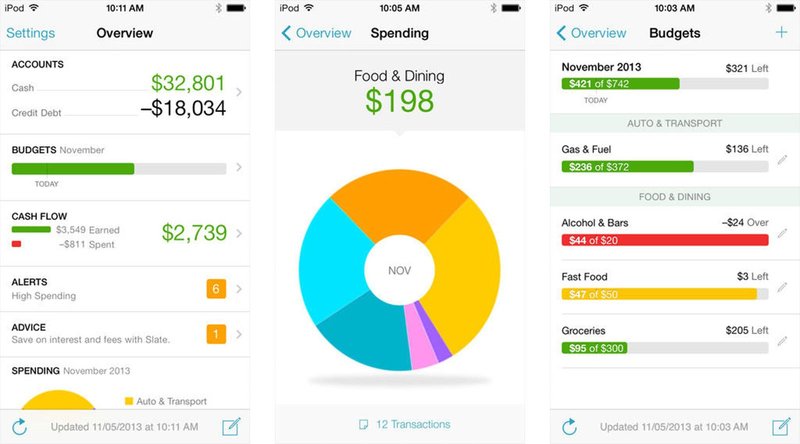

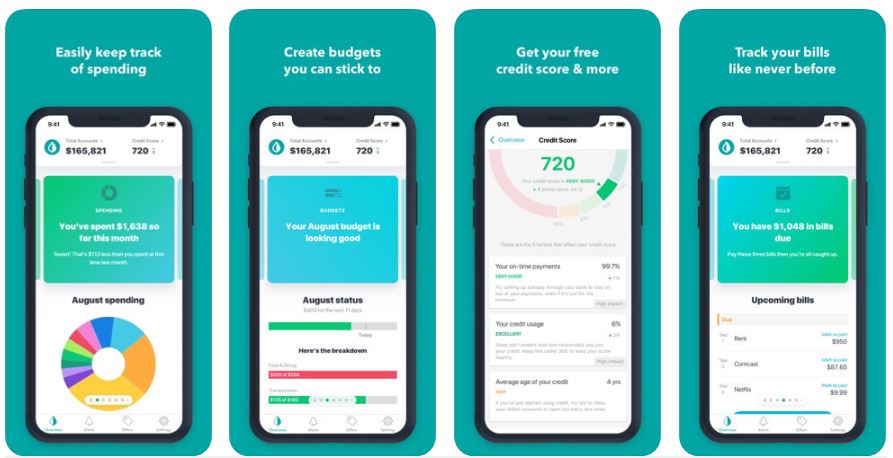

By giving you reports and keeping you apprised of any activity of the accounts attached to the app, you can monitor every penny you spend and see where you spend too much, and then adjust your spending accordingly.

The mobile app can be accessed via the desktop app as well, which helps with consistency and accessibility. That is a quick overview of the app but let’s take a more in-depth look at just how it works.

How Does It Work?

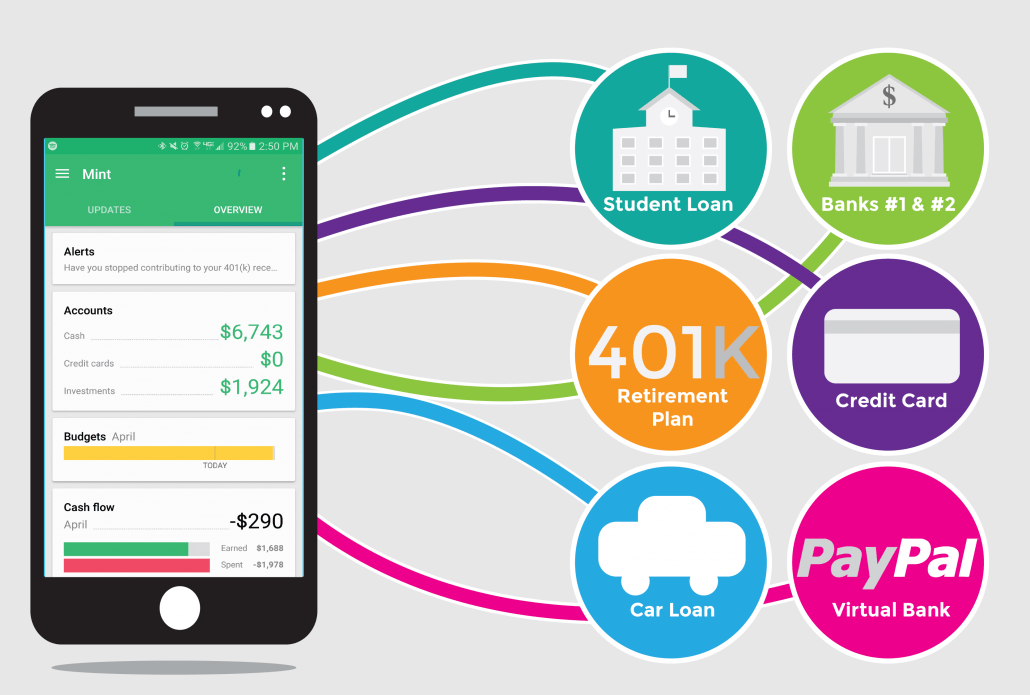

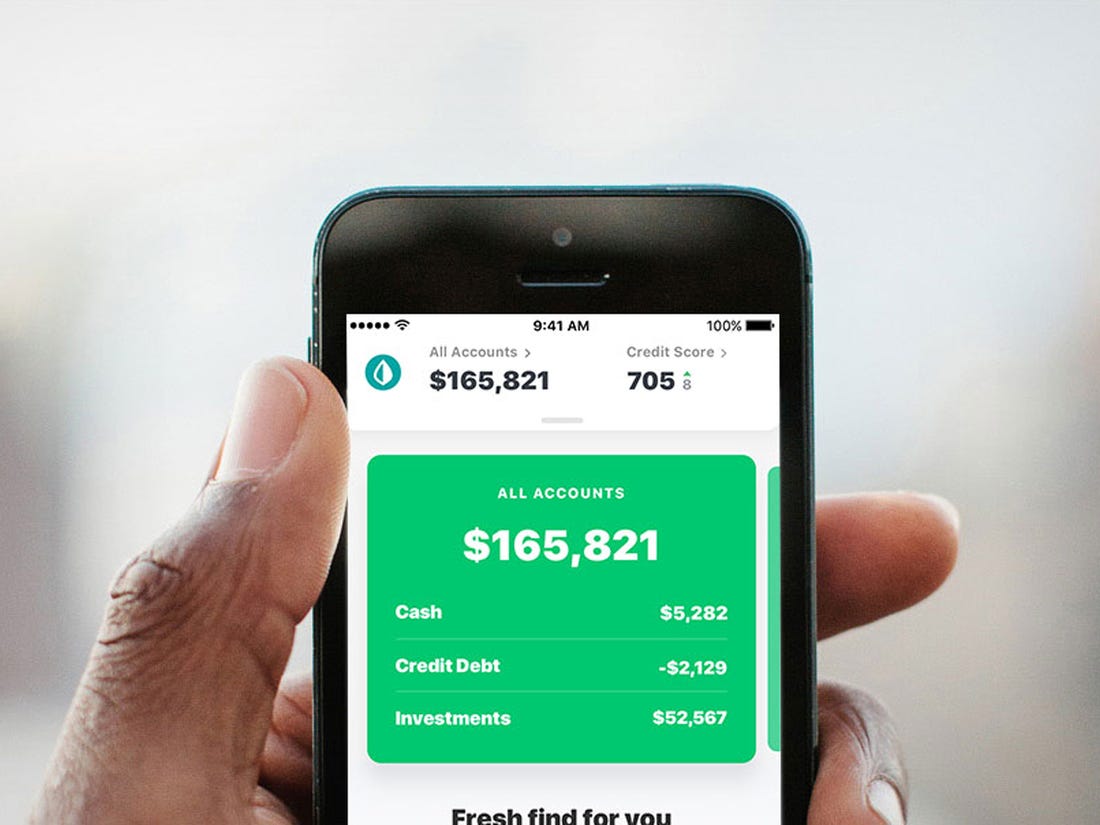

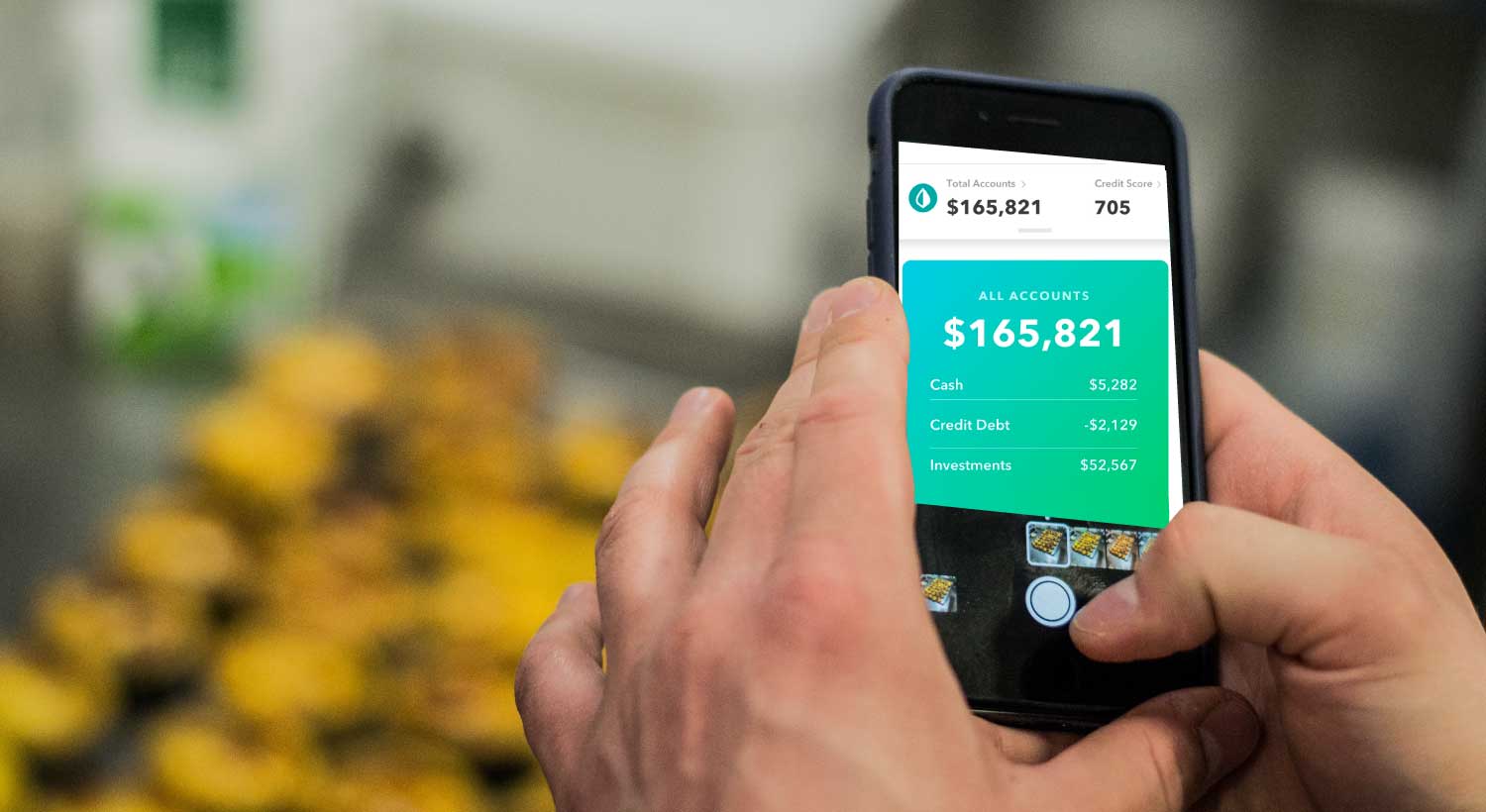

You start by signing up for a free account; all you need is Wi-Fi access. Once you have an account, you can then take a look around and connect bank and credit card accounts to the profile.

Linking these accounts to your Mint profile will allow you to watch your spending as well as to help you save that money you have been wanting to for so long. Once you have that done, you can start refining and customizing your profile.

This can be done by setting up alerts for bills that are due or so that you are aware of any overspending or potential problems with the accounts. If you do a lot of spending with cash, you don’t have to worry either because you can manually enter purchases.

This means that you can track your entire budget from electronic to cash so that you know where all your money goes. The app also allows you to plug in potential spending to ensure that these charges will fit in with your budget.

Main Features

Having an app for your credit cards, your banking, savings, and everything else pertaining to your finances can be time-consuming and confusing. So with Mint, you won’t have to worry about that, and you will save tons of time. The all in one location will make it easier to monitor your spending.

This can be done by logging in your bills and setting up alerts to see what is due and what funds you have accessible to you.

Plus, being able to do that and monitor your credit all in one place will help you with those savings goals as well. It will also let you set up a more realistic budget and manage it.

When it comes to saving, the app also gives you a ton of great tips that, if implemented, might help you save faster. You are also able to digitally apply for a refinancing loan. This system will pre-fill the application with your Mint app data, and you may be able to lock in a rate in less than half an hour.

How To Download

Downloading the app is pretty simple. Once you have decided that you will give it a try, you will first need to go to the store that corresponds to your phone’s operating system.

Therefore, if you have a Samsung phone, you will want to go to the Google Play Store. On the other hand, if you use an iPhone, you will want to go to the Apple Store. Once there, you will click the install button and wait for the app to install.

To set up an account, you will need a valid email. You will enter this into the appropriate field and fill in the rest of the information. After that, you will have an account, and you will start the process of setting up your profile.

This will start with your connecting your accounts and syncing them to your new Mint account. Next up, you will set up your budget. This will be the longest part of the setup. After that, you can set up your goals, If you are thinking of downloading the app, you can do that here for Android and here for iOS.

Is It Safe?

This is a good question and one that many people have when they are doing any kind of online banking or financial tracking. Mint comes from a pretty well-respected financial institute, and so they are very devoted to delivering ultimate security when it comes to your personal information.

There are tons of security features within Mint that are bank level. The app is set up with a 128-bit SSI encryption and uses third-party sites to monitor that. After setting up your account, you will be asked to set up a pin just like your debit card. But that is not the only step they take.

To protect your information, it is kept separate from the servers that house the hardware and software that runs Mint. On top of that, if you do happen to lose that phone, you can log into your computer and delete your account.

They are also very fastidious when it comes to your transactions and send you alerts whenever something looks suspicious. This allows you to react quickly and potentially stop any major damage to your financial standing. So as you can see, security is a high priority to the developers of the Mint app.

Pros & Cons

When you are looking at a financial app, you want to know what are the benefits and the disadvantages and so we have compiled a few pros and cons. Understanding where there are weaknesses and strengths should help you figure out if the app will suit your financial needs and goals.

Hopefully, this list will give you an idea if this app will be the best fit for you.

Pros

- The app is easy and free to use

- You can set up summaries and alerts to be delivered through email or texts

- Able to get a free credit score report through Equifax

- Receive notifications of potentially fraudulent activities as well as low balances through email and texts

- Customizable and easy to understand reports

- For downloaded transactions, you can set them up to be auto categorized for easier analysis of spending

Cons

- The app does not have any investing and bill pay features

- There are some ads that some find a bit annoying

- Multiple currencies are not supported with the app

- Not able to set more than one savings goal

This list was compiled by looking at the features and reviews from current users.

Tips For Using Mint

There are a lot of great tips that can help you do just that with the Mint app. The first big one that we suggest you use has to do with ATM withdrawals and using cash.

If you withdraw money from the ATM to use for quick purchases every day, you may find keeping your budget on point a bit problematic. One way to work around this is to make sure your ATM withdrawal is attached to a category called ATM & Cash.

Then you can change the date of the ATM withdrawal to the end of the month. This will allow you to always know how much money you have on you.

Create Tags

Another great tip is to use tags on your transactions. This will help you verify transactions easier. Make tags that make sense to you. Things, like accepted or seen, are some options you might consider.

Once you have the tags set up, you can link it to the appropriate tag when a transaction comes through. Then if you want to check something, you can always sort by the tag and find the transaction.

This will also help you keep track of transactions that haven’t been tagged so you can watch for fraudulent charges.

Summary

The Mint app is simple and easy to use. The developer also uses high-grade security to ensure your financial and personal information is safe.

So if you’re looking for a good financial tracking app, Mint might be a good choice for you.